A few of our subscribers have asked about the general trend in the economy, and why we expect a deep recession to be in its initial stages. What about the Federal stimulus activities, including purchases of corporate debt, and those direct payments to individuals? Below, we’ll discuss current economic trends, the GDP, and Leading Economic Indicators to help clarify these topics.

The current status of the Federal program of direct stimulus payments to individuals is that $200B out of our estimated $250B has already been paid out, with the remainder due to be issued over the next few weeks. The total Federal programs already signed into law amount to about $2.5T, about TEN TIMES larger than the direct payments portion of $250B. So where is that other 90%? Is it helping in any way? Will it prevent a recession?

Let’s answer the last question first.

No, it will not prevent a recession. The recession (a contraction of GDP lasting six months or more) has already begun, about mid-February, as soon as the initial collapse of oil and the stock markets began, and businesses began laying off workers. The Federal Reserve has already published declining GDP values for the first quarter of 2020, and by the end of the second quarter, we expect to see declines well in excess of 5%. (The decline during the Great Recession was only 2.5%, for comparison purposes.)

The Federal Reserve has purchased a large amount of US Treasury debt, and corporate debt, in order to provide “liquidity” (a term hammered home by Fed Chairman Powell), and has expanded its “balance sheet” by over $3T to prop up federal spending and the quality of corporate debt. Many expect at least as much or more additional Fed purchases. (We do not believe that the Fed will buy equities to prop them up. That would be a complete misapplication and misdirection of their financial powers, and is likely even declared to be a forbidden activity.)

Now back to the basics of economics.

GDP is a product of the money supply, and the velocity of money, i.e. how fast that money supply is being spent:

GDP = {size of M2 money supply} x {velocity of M2}

The Federal stimulus, in large part, has NOT yet been spent. It will be adding to the supply of money, but it is not going into activities where it can be spent with significant velocity. That money, right now, will be spent to maintain existence and “keep the lights on”. There’s not enough to save a lot of jobs, plus amounts needed to go into the demand-side of the economy to stimulate velocity quickly, which is what is going to be required to prevent a very very deep and protracted contraction.

We hope that the economists within the Federal Reserve, and the academic community, will be able to “reach” the politicians and help develop the political will to create much larger direct payments to individuals, designed to be spent rapidly, as the best method to mitigate the worst of the contraction. Money put in at the bottom of the economic ladder, with some “spend it now” strings attached, is what will stimulate demand and improve the velocity of money most rapidly.

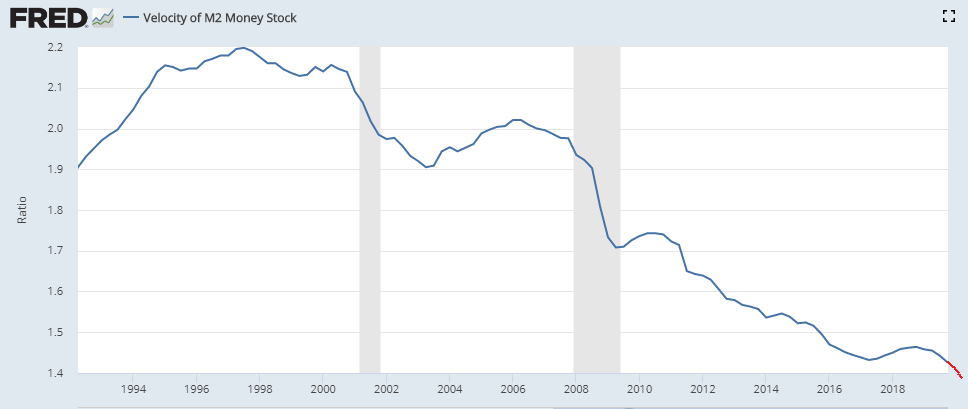

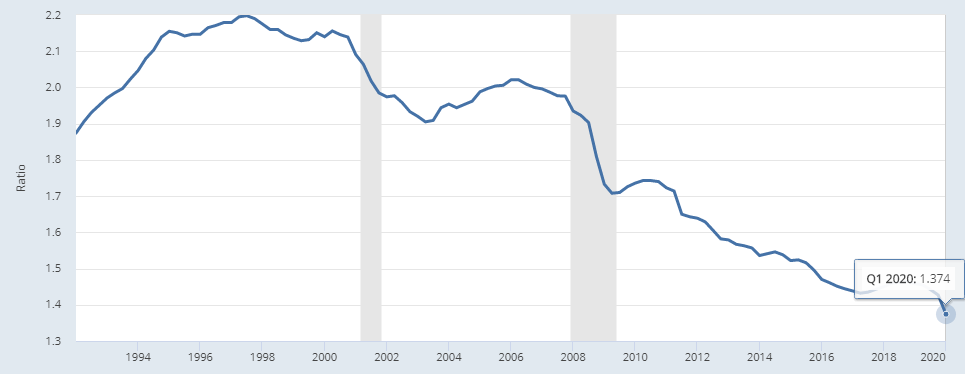

We previously published a chart with our projection for the velocity of money. This is what we put out in April:

A few weeks later, the Federal Reserve confirmed our projection, by issuing this new value for 1Q2020:

Expect further SIGNIFICANT declines in the Velocity of Money for the second quarter.

Leading Economic Indicators update:

There are two months in which the Federal Reserve does NOT release LEI information – March and May. Therefore, in those time periods, we rely solely on our second source of LEI information, where April figures were just released on May 21. For April, their basket of LEIs was down ANOTHER 4.4 percent, and their March number was revised downward from -6.8% to -7.4%. These drops are large and unprecedented…expect numbers from the Fed, issued during the first week of June, to be in line with the description of “terrible”. They will appear in our regular June report. The AP-LI indicator is solidly red.

Attempts to address economic issues as we describe above must all occur along with an improvement in the outlook for dealing with the public health issues associated with the spread of coronavirus and COVID19 symptoms, so that people can more confidently return to more normal patterns of work, social activities and consumer spending.

Effective treatments and vaccines are the ingredients for this, and a deployable vaccine is still a 2021 event, despite “Operation Warp Speed”. Why? Because testing for effectiveness and safety still takes several months, even for vaccine candidates currently in trail. Most will not report initial results on small trial populations until late June, or July. Second phases on larger trial populations will take a few more months, and parallel scale-up of vaccine production (in parallel with the second phase trials, guaranteeing a few dead-ends for production ramp-ups) will also take many months to reach levels of readiness to deploy hundreds of millions of dosages.

The first half of 2021 is the REALISTIC timeframe to expect successful widely deployable vaccines, IF they are found amongst the early trial candidates. Keep in mind that this estimate cuts short the normal development cycles for widely deployed vaccines by YEARS, and so is still very optimistic.

So what should we expect to see over the coming couple of months (May through July)?

Unemployment continues to grow by millions of lost jobs per week. With states re-opening social and business activities under multiple limitations, job declines will continue. We are currently at about 30M jobs lost, and we should expect that number to reach 35M-40M by mid-summer, even with reopenings.

Many of the service jobs that are going to initially come back are going to be limited in hours per individual, not nearly at levels found pre-COVID. So a 25% level of unemployment, on par with the worst the US has ever had in “modern times” (since 1900), is NOT going to come roaring back. Double-digit unemployment levels will be with us for several years, and that adds to GDP-contracting forces.

A wave of corporate bankruptcies is beginning, and some well-known large companies will be involved. Just yesterday, Hertz announced they will be filing for bankruptcy.

Several oil drilling and exploration companies have already filed due to the collapse in the oil industry. (Note oil prices have recovered somewhat, but we do not expect recent prices in the $30’s/barrel to hold up for very long, and oil should fall back to the high teens and low twenties sometime during the remainder of the year.)

In terms of the equities markets, the mainstream indices (DOW, NASDAQ, S&P500) are being skewed from reality by a few tech companies that have not been hard hit by the recession…yet. However, underneath these tech-weighted indices lies this truth: Equally weighted S&P500 index is down about 20%, and US small-cap stocks are off, even more, about 23%.

Declines in equities are INEVITABLE, and they will be steep. Given the current disconnect between the equities markets and economic fundamentals (including our projections for the GDP), we think that as more and more people begin to communicate the inevitability of a DECLARED recession, around mid-July, that the optimism driving purchases in the markets will dry up. Perhaps more “smart money” will be leaving sooner than that, in anticipation of the announcement.

We emphasize our warning about equities.

Resist the urge to bargain hunt or bottom fish right now. Cash is the place to be until equities fully reflect the reality of a deep recession. If the GDP contracts by 15%, we can expect the S&P500 to go below 1000 before it bottoms out. It sounds absurd, but it is not an ignorable probability. We will keep updating these estimates as the recession progresses.

Please stay as safe and healthy as you can!