This article, written by Rich Vesel – Founder of Advanced Projections, was originally written for and published by Advisor Perspectives, linked here.

In our original search for advanced indicators of recessions, my colleagues and I at Advanced Projections searched for a set of reliable trends that could be found in non-obscure economic data that would provide clear and unambiguous leading indications of impending recession. Our set of six indicators, derived in 2013, was then back-tested against every one of the six recessions that occurred between 1972 and the end of 2013. With the confidence in their reliability established through this process, we proceeded with the publication of these indicators as a service to investors, business owners, and financial planners. These indicators proved reliable in the leadup to the 2020 recession, which was then accelerated and amplified by the appearance of COVID. But the indicators had already been pointing to a recession, months before “COVID” was ever spoken.

These indicators are again strongly pointing to an incipient recession.

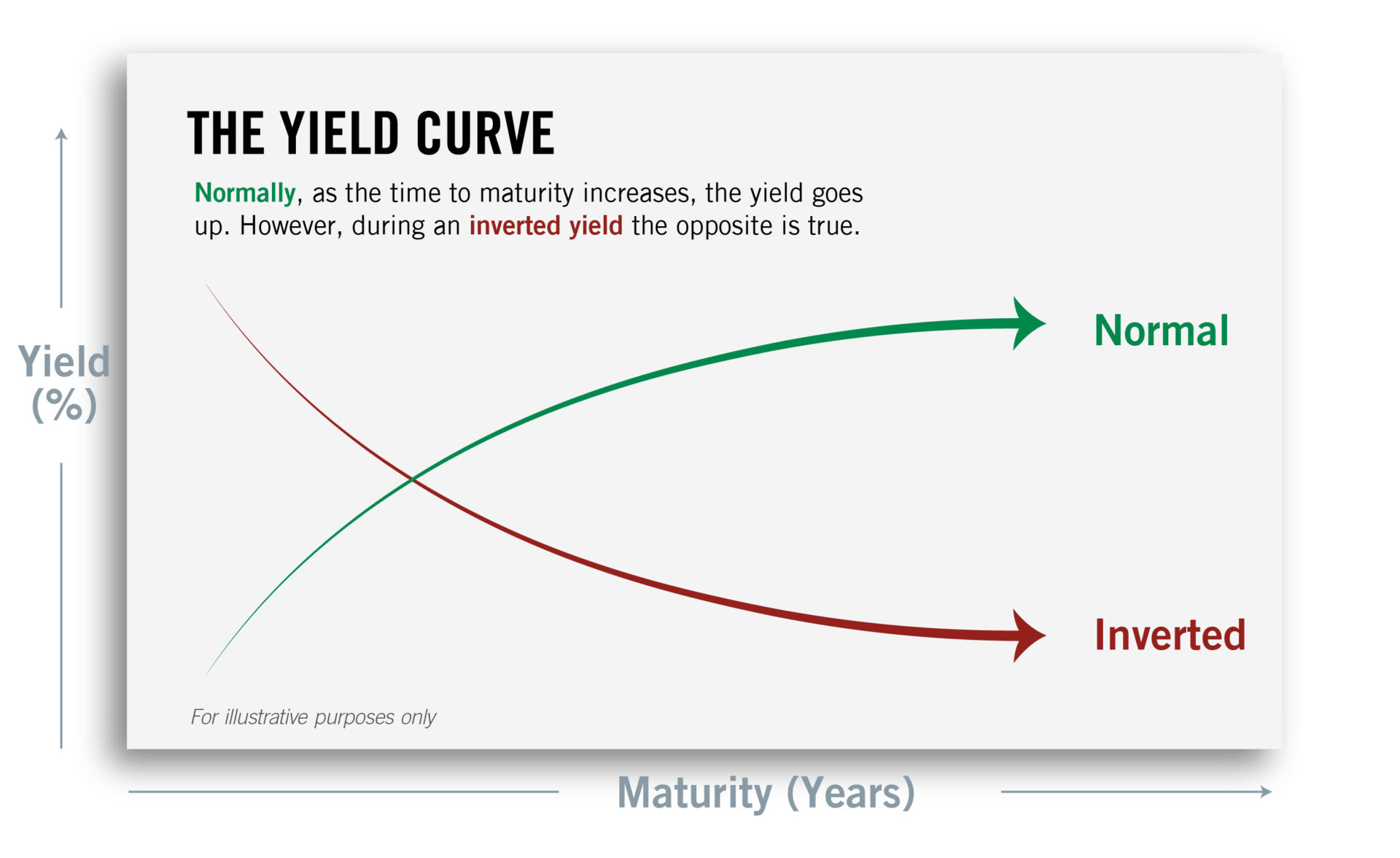

One of these six indicators is something that most financially savvy people know of qualitatively as a yield curve inversion. This is a condition in which one or more short-term interest rates exceed a longer term rate, which is the opposite of the normal state of rates along the Treasury yield curve. The Treasury issues debt instruments with maturities of 1, 2, 3, and 6 months, along with 1-, 2-, 3-, 5-, 7-, 10-, 20-, and 30-year bonds. The normal slope of this yield curve is that for each step outward in maturity, the yield value increases.

In searching for a telltale inversion, you would have to look along the curve to decide which pair of maturities to compare, one longer and one shorter. There are 66 different yield-pair options to consider! Adjacent curve values, such as comparing the 20-year against the 30-year, or the two-month against the three-month, were clearly noisy and useless to use as “definitive indications.” The choices lay in finding a short-term rate in the one- through six-month group, and one in the five- through 30-year group, to provide a valid and useful comparison. That still left 20 different options to explore.

We found that the best, most-reliable metric was the three-month versus 10-year rate comparison.

It has provided seven pre-recession warnings since 1972, without any false positives under the conditions where the shorter term yield exceeded the longer term yield. it signaled within a few months of the beginning of recessions as declared by the NBER (and thus also the Federal Reserve).

The NBER typically declares recessions after six months of negative GDP growth, plus a few months for it to “digest” the data and circumstances before making its official announcement, which it then uses to retroactively declare the beginning of the recession. You are left hearing about an officially declared recession eight to 12 months after it began. The declaration of the end of a recession by the NBER typically lags that event by an even longer delay. For example, the end of the deep but brief recession of 2020 was announced by the NBER 15 months after the fact!

You really would want to know what is happening with these leading indicators, rather than relying upon sorely delayed official declarations, to stand a chance of adapting your financial strategies and business decisions based upon what is likely to happen in the immediate future.

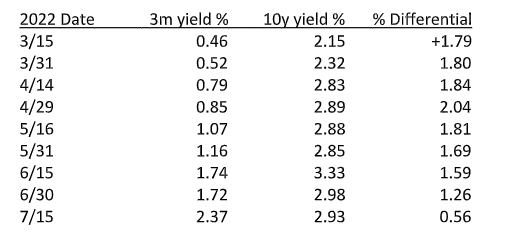

Here is what the three-month versus 10-year rate comparison has been doing over the past few months:

By the end of July, in the face of the next large increase in the Fed Funds Rate (FFR) that will be declared by the FOMC, this rapidly narrowing gap will close further. The markets are already beginning to price in that FFR increase, and once it becomes a reality, the above differential will go negative in very short order, probably within 60 days, or perhaps even ahead of the actual rate announcement. Then we all will be holding our breath for the next FOMC meeting, which will be almost two months later – a period certain to contain more reports of high inflation coupled with low-unemployment.

As established in the previous six recessions from 1972 to 2018, when this specific inversion into negative territory occurred, it marked the beginning of a recession within 90 days. While I see this as the likely scenario, it is possible for this inversion to occur a bit further in advance of the recession, due to a continuation of the recent large influx of foreign capital into the Treasury bond market.

The recession in 2020 was an exception, where two inversions occurred further ahead of the COVID-induced crisis. The first full inversion occurred just eight months in advance of that crisis, and the second occurred less than two months before the declared start date of that recession. Tight labor combined with low inflation likely accounted for the prolonged delay between the initial inversion indication and the start of the recession. Without COVID, the delay may have been a few months longer. Also, that unique pair of conditions does not exist today. Now, the Fed is being far more aggressive as well.

Our indicator system uses a green-yellow-red “traffic light.” Concurrent with the July 15 data, our yield-curve indicator has moved in real time from green to yellow. When it goes negative, the indicator becomes red, with a very high probability of closely marking the beginning of the next recession.

See More from Advisor Perspectives:

https://www.advisorperspectives.com/articles/2022/07/16/why-inflation-will-not-go-quietly-into-the-night

https://twitter.com/AdvPerspectives

https://www.linkedin.com/company/advisor-perspectives