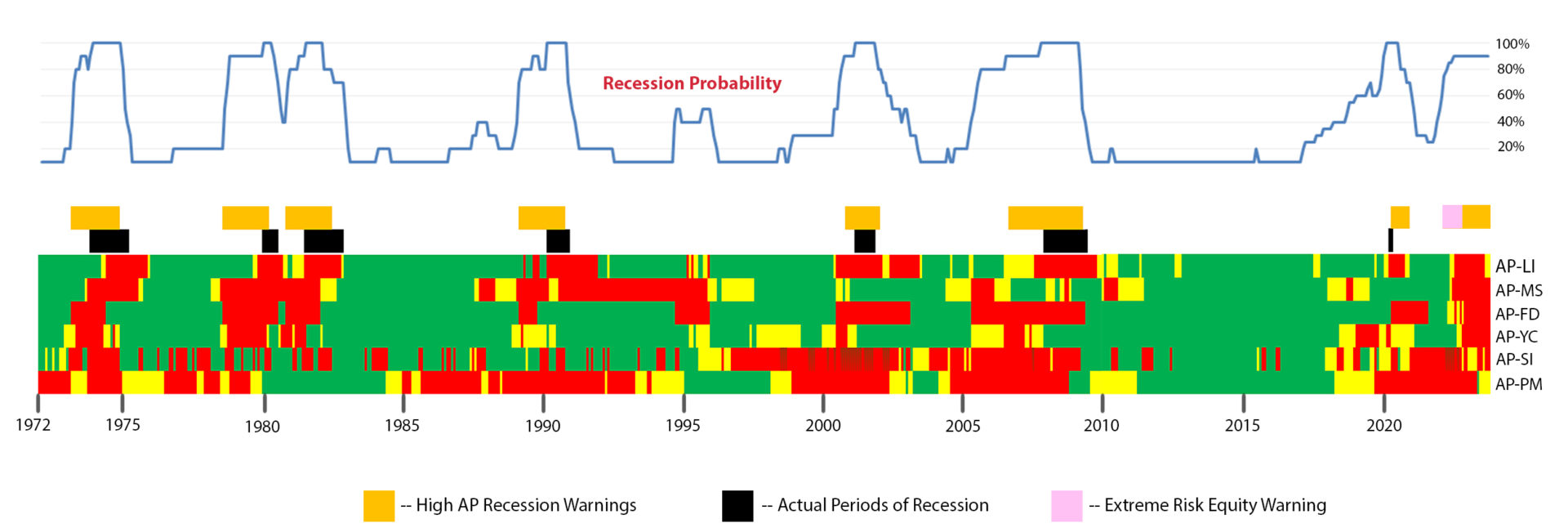

GREEN tells us that the referenced recession indicators are not exhibiting any warning at the date of publication. Observe the long stretches of “all-green” in between recessionary periods in the Historical Chart above.

YELLOW tells us that these recession indicators have entered a cautionary region, where they should be watched for further degradation and where other recession indicators should be observed for confirmation of a problem.

RED will show a full-on warning level for that particular recession indicator, signaling that monitoring of this sector is clearly showing a problem – which has in the past, has reliably exhibited itself as a forewarning of recessions.

Central Bank indicators are published by the Federal Reserve and reflect their own analysis of national and regional economic health, as well as their calculations of the likelihood of a recession. This is usually one of our last indicators to enter a Warning state, simply confirming what we have already projected.

Baskets of leading economic indicators, as collections, reflect overall growth or contraction of economic activity. These indicators include measures of level and growth in productivity, employment, housing, consumer confidence, industrial purchasing confidence, and much more.